Marketing Capital Plus

[New Retail Era Marketing Capital System Coaching Program Implementation]

I. Project Background:

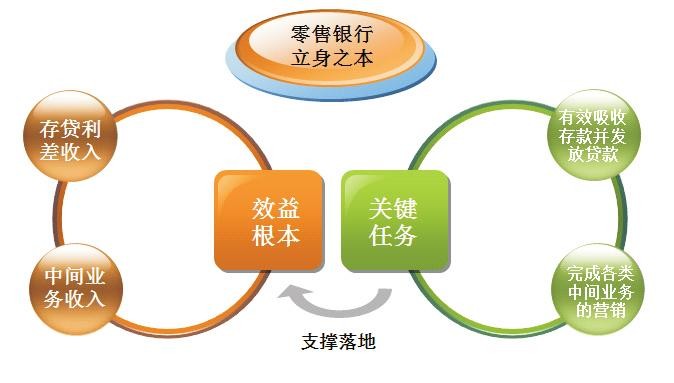

In 2016, the banking industry's year-on-year profit growth entered the zero-growth era panic! For a long time, the interest rate spread and intermediary business income have been the foundation of banks' survival profits. Therefore, effectively absorbing deposits, issuing loans, and completing various intermediary business marketing work have become the foundation for banks' survival. Marketing indicators for deposits, loans, and intermediary business products naturally constitute the core KPIs of each bank. However, in the zero-growth era, how will banks transform their profit models?

“产品搬运工”的时代已经过去,“价值塑造者”的时代已经来临!单纯为客户提供金融产品服务,继续依靠传统营销理念与策略来完成KPI,来赚取存货利差与中间业务收入,只会让银行丧失更多的主动权,让生存之路更加暗淡无光……

II. Project Approach:

Banks that want to survive with dignity and thrive must transform their business models, marketing models, and talent management models. On the path of transformation, some banks have already taken the lead.

Example 1: [Women's Bank, also known as Good Bank]---Suitable for banks in 72 large and medium-sized cities

★ Aesthetics - Integrated charm building for Industry 300;

★ Assets - Organized 65 investment preference products;

★ Family - Built three industries: elderly care, child care, and wellness;

★ Social - Clubs, venues, parenting communities and other social circles;

Impressive results: 2,490 new accounts opened, 1,350 VIP customers upgraded, deposits of 150 million; 120 POS machines; consumer loans exceeding 20 million; business mortgage loans exceeding 30 million,

Sold over 4,600 women's credit cards, conducted over 100 various customer value-added service salons, saving the bank over 100,000 yuan in marketing expenses, etc.

Example 2: [Home Ecosystem]---Suitable for banks in 2,800 cities and counties

★ Home Purchase - Demonstrate our bank's branch and customer advantages, reach property internal purchase agreements with four real estate developers, and provide gifts;

★ Expansion - Conduct marketing activities at property sites, matching comprehensive financial service solutions such as renovation loans and parking space loans;

★ 延伸---整合当地建材市场的困局,For其引流,并与建材市场运营管理方成立‘诚信建材联盟协会’,按照各商户经营利润和品牌经;

★ Identify customers above three-star level, build a complete after-sales service system, and provide certification and credit, achieving win-win cooperation;

Impressive results: Developed settlement and payroll services for four real estate developers, facilitated 480 property transactions, over 1,000 property mortgage loans, renovation loans for over 2,000 households, parking space loans for 1,800 households; developed one building materials market operator with credit of 300 million; developed over 600 building materials merchant accounts, POS, card loan products, deposits of over 60 million, credit of 20 million; saved approximately 150,000 yuan in gift expenses.

正如上述案例呈现的,通过多维度的分析典型客户的需求点、痒点、痛点,到最后引爆爆点,进行资源的有效整合,挖掘存量和潜能资本,整合出属于区域客户的价值归集高地,在金融产品Service之外创造出更具有引客户的供给价值和筹码,让客户主动来敲门。通过高效响应客户的非金融需求来实现金融产品的盈利目的,这种模式才是银行未来应该构建的盈利模式,这种模式我们称之For“营销资本+”。

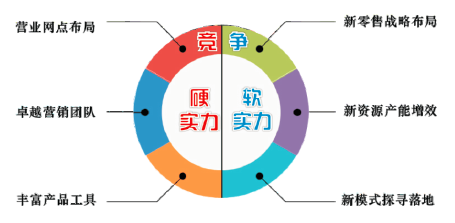

强化我行软实力,五力齐驱,有效构建“一体两翼五主题”的产能共赢共享生态圈,本项目将助您开启银行轻松盈利新纪元。

★【Decision-Making Power】Make bank strategic positioning clearer

★【Product Power】Make bank product value-added more precise

★【Planning Power】Make bank activity planning more effective

★【Execution Power】Make bank execution more proactive

★【Communication Power】Make bank brand value more professional

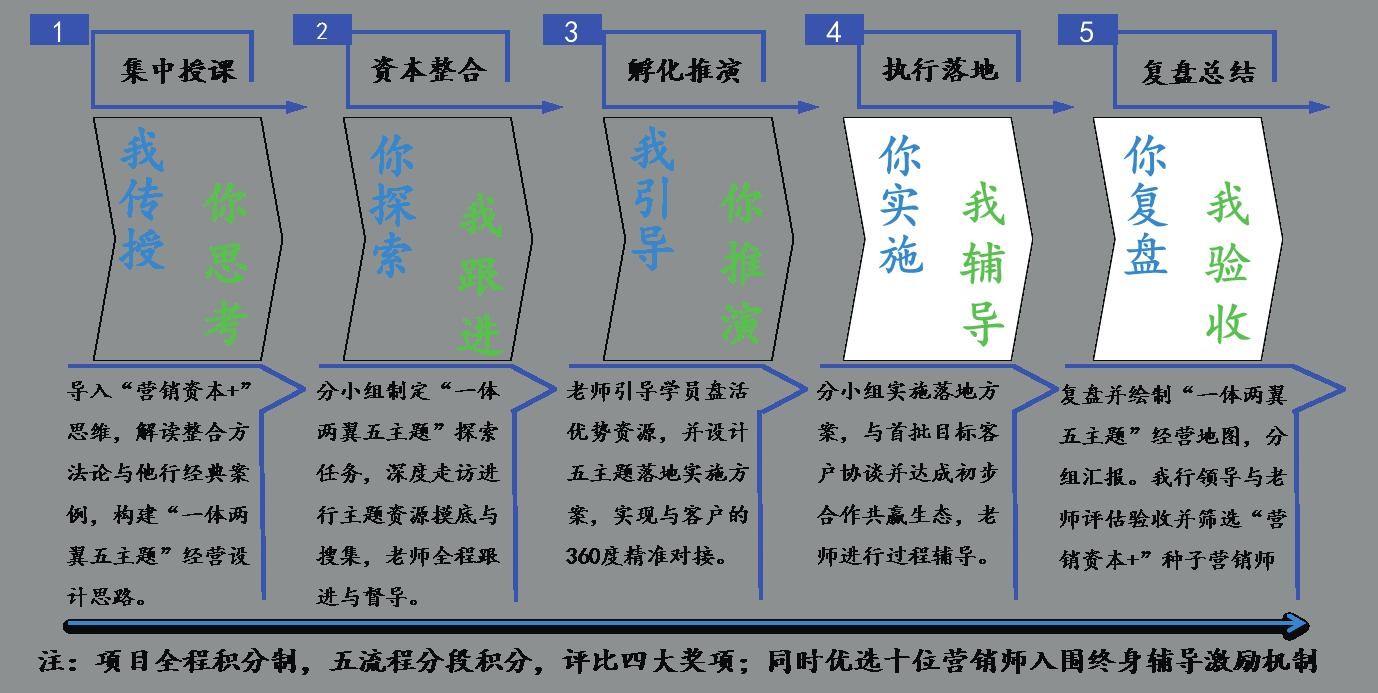

III. Development Process

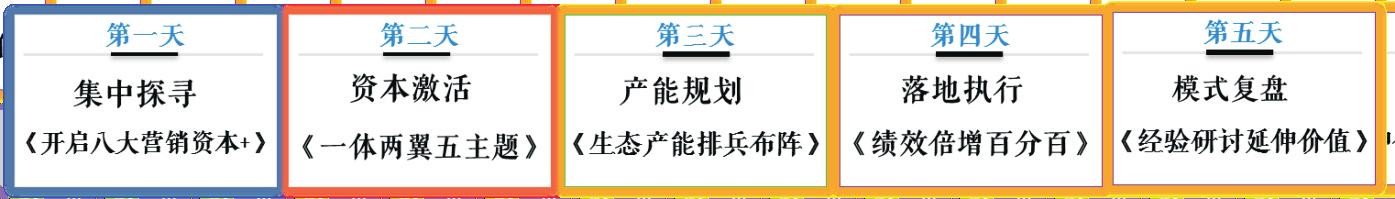

IV. Project Implementation

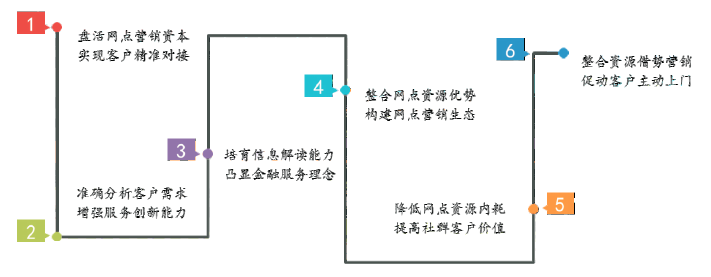

V. Project Benefits

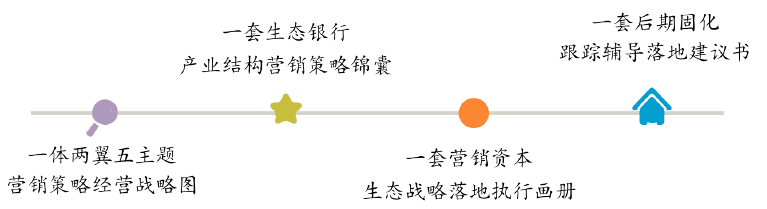

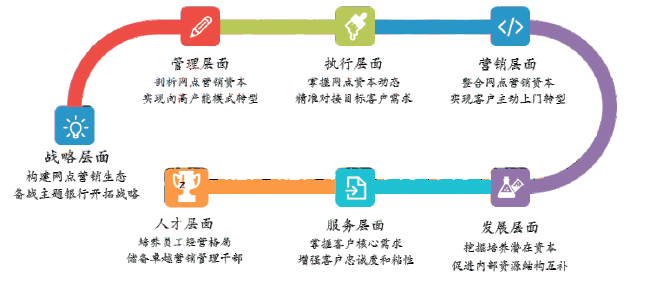

VI. Project Deliverables